The #1 Thing Sellers Need To Know About Their Asking Price

When you put your house on the market, you want to sell it quickly and for the best price possible; that's generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.

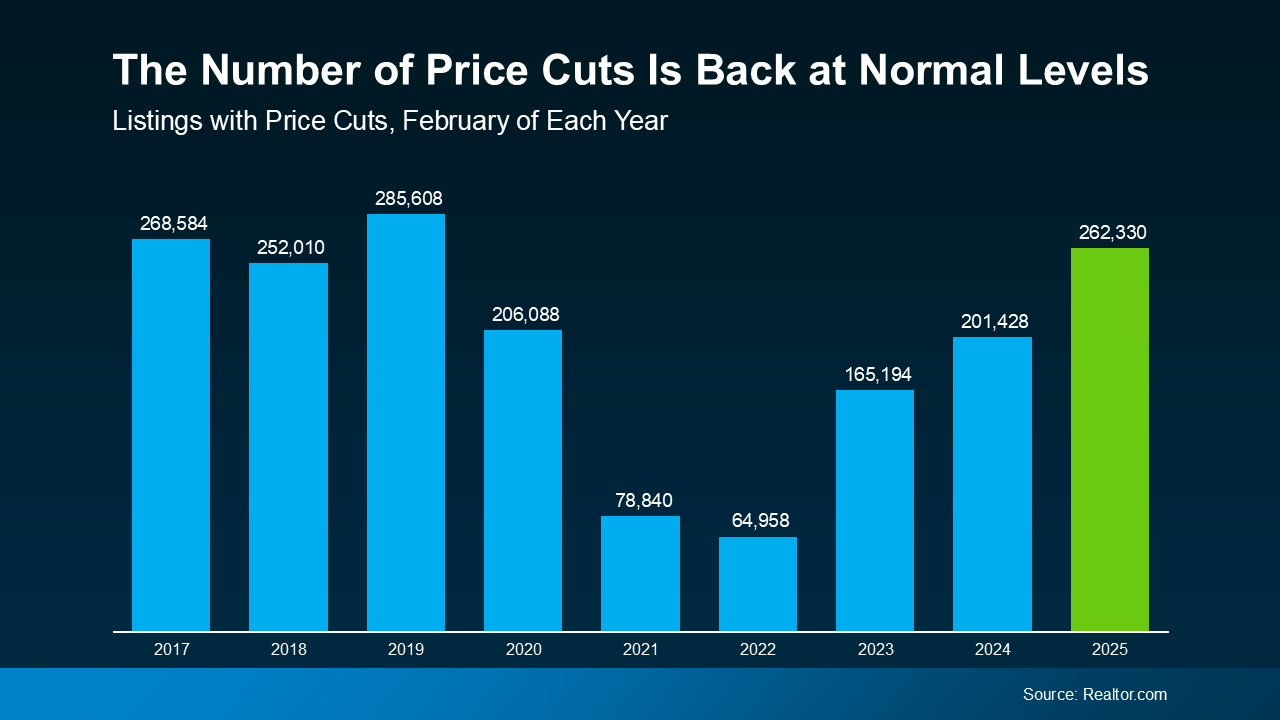

According to data from Realtor.com , in February, price cuts were the highest they’ve been in any other February since 2019 ( see graph below ):

If you consider that 2019 was the last true normal year for the housing market – that's a big deal. We’re getting back to what’s typical for the market.

This isn’t the same frenzied seller’s market we saw a few years ago. You may not get the same price your neighbor did at the height of the pandemic. And that means you may need to reset your expectations.

Because here’s the reality. If you shoot too high and have to lower your price after the fact, you could actually end up walking away with lower offers than if you’d priced it right from the start. So, how do you avoid that? You lean on your agent.

How an Agent Helps You Nail the Right Price

A great agent doesn’t just pull a number out of thin air. They’ll use real data and market trends to make sure your house is priced based on what your specific home is valued at today. So, you’re setting a realistic price – one that’ll draw in serious buyers.

And based on your agent’s analysis of your local market, they may even recommend strategically pricing slightly below market value to help your house attract more eyes and more competitive offers. Here’s how your agent will determine the right number for your house:

- They look at recent sales. What did similar homes in your area actually sell for? Not list for, sell for.

- They analyze local market trends . Your home’s value isn’t just about what you want for it, it’s about what buyers in your area are willing to pay.

- They craft the right strategy. They’ll make sure your home is priced to attract attention and create a sense of urgency among buyers.

Why Overpricing Backfires

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

- Buyers may not even look at it . Today’s buyers are more budget-conscious than ever. If they see a home that seems overpriced, they’re likely to skip it completely rather than try to negotiate.

- It could sit on the market for too long . The longer your home sits unsold, the more buyers will assume something’s wrong with it. That can make it even harder to sell down the line.

- You might end up getting less . Homes that require a price cut often sell for less than they would have if they had been priced right from the start.

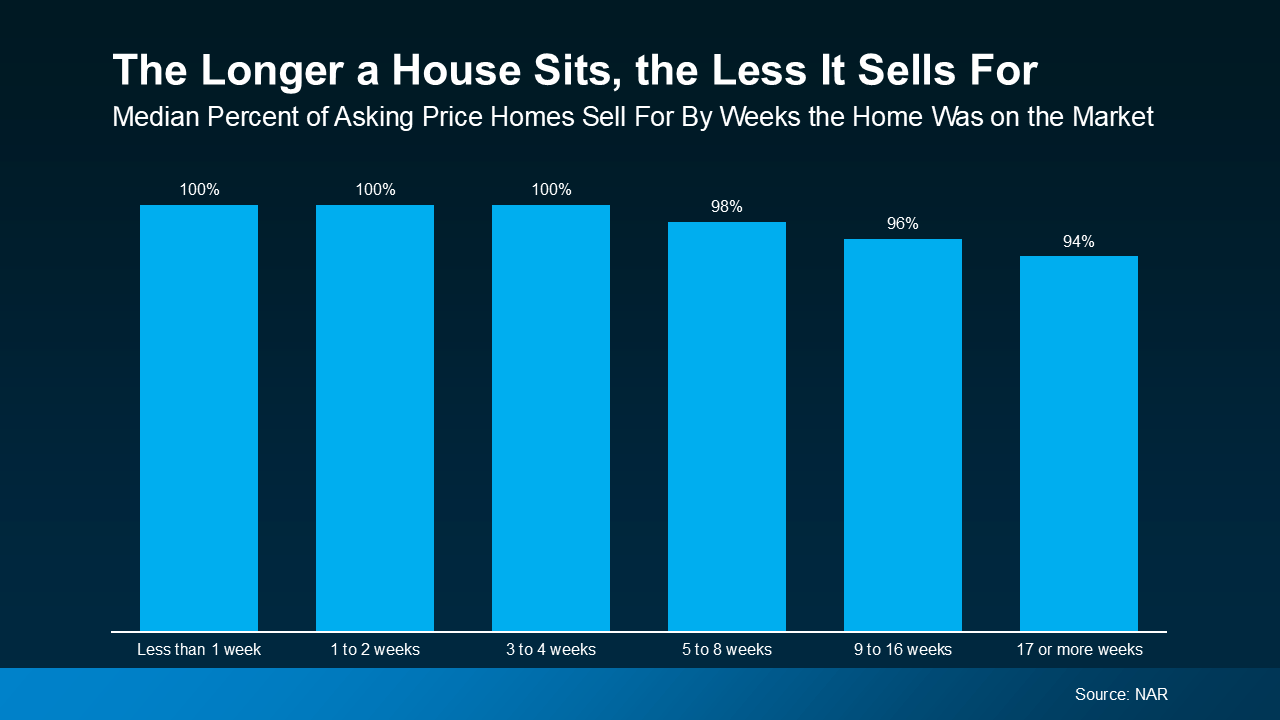

You can see that shake out in the graph below. It uses data from the National Association of Realtors (NAR) to show that the longer a house sits, the less it’ll sell for:

This graph shows that if a house sells within the first 4 weeks it is listed, it usually goes for full price. Based on experience, that's what usually happens to homes that are priced at or just below current market value. If it’s priced right, buyers will be interested, and, ultimately, willing to pay the asking price – or compete with other buyers and even go over asking.

This graph shows that if a house sells within the first 4 weeks it is listed, it usually goes for full price. Based on experience, that's what usually happens to homes that are priced at or just below current market value. If it’s priced right, buyers will be interested, and, ultimately, willing to pay the asking price – or compete with other buyers and even go over asking.

But if a house isn’t priced right, it doesn’t sell as quickly. And this graph shows that, after the first 4 weeks on the market, the price starts to drop from there. That’s because buyer interest falls off the longer it sits. So, it becomes more likely a seller will either accept a lower offer because that’s all they have, or opt to do a price drop to draw people back in.

Bottom Line

The last thing you want is to list too high, watch your house sit, and then have to drop the price just to get attention. Talk to a local agent so that doesn’t happen to you.

Want to make sure your home sells quickly and for the best price? Connect with an agent to talk about the right pricing strategy for your house.